What is an available balance?

Married couples can withdraw £45,200 without having to pay tax. And while there are some ways to cash out your Bitcoins without paying taxes, the likelihood of that lasting once government regulations tighten is doubtful. You can try doing it, but there’s a high chance of getting caught and probably not seeing any of your Bitcoin ever again. Withdraw Your Bitcoins or Spend Them Online. There are many places that you can withdraw them at a reasonable fee, whether you are withdrawing just a few Bitcoins or making a Bulk Withdrawal. All you need is to find the best service that suits your needs, and is safe and secure.

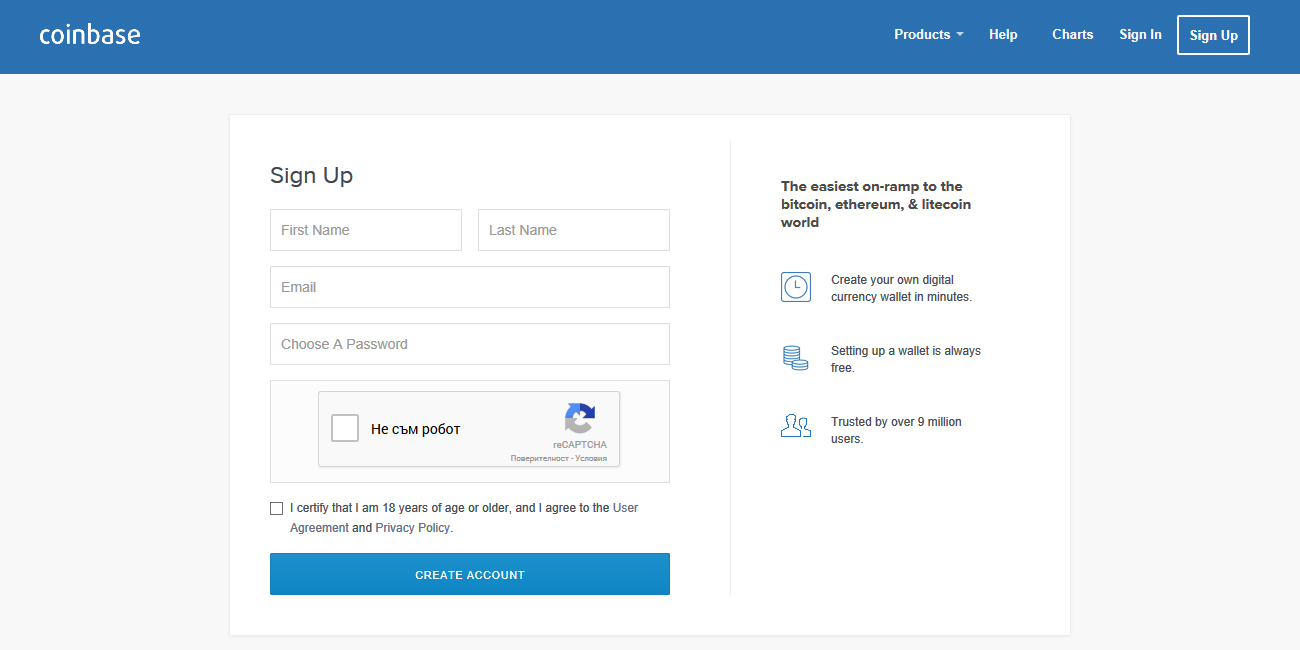

Your available balance is how much you can withdraw or transfer immediately out of your Coinbase account. It’s directly related to purchasing crypto or depositing fiat currency using a linked bank account. For security reasons, you will not be able to immediately withdraw fiat deposited using a linked bank account or send crypto purchased with such funds off of Coinbase (we call this “withdrawal availability”). Wire transfers and debit card purchases do not affect your withdrawal availability, but are subject to any existing holds on your Coinbase account.

- This process is called ‘transfer’. In order to transfer a crypto position, you will need to open the Edit Trade window in the Portfolio. Under “Invested”, eligible users will have an option to transfer. To find out which regulation your account is under, please click here.

- There are many online exchanging Platforms that are offering digital cash services like withdraw bitcoin from blockchain to your bank account or Paypal. You can also cash out my bitcoin by using any broker and through a peer-to-peer exchange.

- Your standard US bank account cannot support storing Bitcoin. You must withdraw it to a Bitcoin wallet. You can withdraw your Bitcoin to other Bitcoin-custody partners, and we even encourage you to withdraw it to a vault set up by Unchained Capital.

What does “funds on hold” mean?

Funds on hold is the fiat currency value of your recent bank deposits and crypto purchased with those deposits. This total amount will always be represented in fiat, regardless of whether you deposited funds or purchased crypto. Before confirming a bank deposit or crypto purchase with such funds, Coinbase will always tell you when those funds or crypto will be available to send off of Coinbase or withdraw to your bank. The amount of funds will be calculated based on many factors, which include your account history, payment activity, and transaction history.

What does “collateral” mean?

Coinbase uses the term 'collateral' to specifically refer to a borrower’s BTC funds, equal to the USD value of the loan at the time of loan origination, that Coinbase ‘locks up’ in order to secure the loan. In the event that a monthly payment is missed, Coinbase will sell off just enough of this BTC collateral to repay the missed payment.

Learn about borrowing from Coinbase.

How is my available balance calculated?

Your available balance is your total account value minus your funds on hold.

Are crypto value increases affected by the holding period?

No. Any increase in value of cryptocurrency does not affect your withdrawal availability.

Are wire transfers or debit card purchases subject to withdrawal availability?

Yes. Your purchases or deposits are subject to any existing restrictions on the account, regardless of which payment method you used. In general, debit card purchases or wired funds from your bank to your Coinbase USD wallet do not affect your withdrawal availability—if no restrictions exist on your account, you can use these methods to purchase crypto to send off of Coinbase immediately.

Can I Withdraw My Bitcoin From Paypal

My withdrawal availability time frame hasn’t expired and I want to withdraw funds immediately, what do I do?

Transfer Bitcoins To Bank Account

You can still buy, sell, and trade within Coinbase. However, you will need to wait until any existing Coinbase account holds or restrictions have expired before you can withdraw funds to your bank account. Withdrawal-based limit holds typically expire at 4 pm PST on the date listed.

Do I have to wait for withdrawal availability before transferring to Coinbase Pro from my Coinbase USD wallet?

Yes. If you deposit funds to Coinbase from your bank account, you will have to wait until your withdrawal availability time frame has expired before moving those funds to Coinbase Pro. When you try to deposit USD to Coinbase Pro from your Coinbase USD wallet, you will see an “Available for Deposit” amount. This “Available for Deposit” amount is how much you can transfer immediately.

How To Cash In Bitcoin

You can always deposit USD directly from your bank account to your Coinbase Pro USD wallet—this does not affect your withdrawal availability.